2023 Inheritance Tax allowances – and actions to take! I wrote a blog called Understanding Inheritance Tax a while ago, and it’s always been one of our most popular articles. It simplifies what can, for some, feel complex and you can read it here. It covers all the basics – allowances, rules, NRB, RNRB and those bits of jargon! And it gives some great examples for single, married and unmarried people.

But since I wrote it, what’s changed? Well, nothing at all! 2023 Inheritance Tax allowances have been frozen! And that’s a problem! Read on for why that is, and whether you need to act now. If you don’t you, like many others, could get caught out in the IHT trap.

The rules are the same – still !

Inheritance Tax (IHT) has been around for a long, long time – since the 17th century in fact! In those days it was called “Death Duty”. The modern version was introduced in 1894 as estate duty, and only the very very wealthy paid anything.

Allowances (the amount you can have before you pax tax at 40%) have increased regularly over the years. The last “tweak” to the allowances was introduced in 2015 when the government announced that the allowance would eventually be £1m. But that wasn’t really true – a bit of political spin really. Because that total allowance is only true IF you are married, IF you have a home worth more than £350,000 and IF you have children to whom you pass that home. So, it discounts a lot of people, who end up with significantly lower allowances than that.

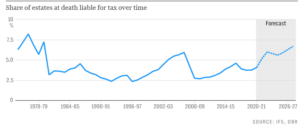

The 2023 Inheritance Tax allowance of £325,000 for an individual was set in 2009. And the additional “residence allowance” of up to £175,000 was set in 2021. Those allowances have just been frozen, again, until 2026. That means that as the value of property increases, more and more “normal” families are paying IHT. In 2000, £2bn was collected in IHT from the richest families. The forecast is that £8bn will be collected in IHT by 2025.

So more people need to be aware and to start planning!

Who is at risk?

Inheritance Tax is payable by your estate on death, at 40%, of your net estate (what you own less what you owe) over your allowances. For some people, those allowances are quite low given rising property prices. Many of the clients I talk to are unaware and could get caught out. These include:

- A single person with no children. Your Inheritance Tax allowance is only £325,000. So, if you own your own home and have some savings, it could easily mean you are over your allowance.

- A single person with children. Your 2023 Inheritance Tax allowance is £325,000 but you could qualify for the additional residence allowance if you leave your property to your children. That could add up to £175,000 to your allowance, meaning a total of £500,000.

- Married couples with no children. Your allowance is £325,000 – combined £650,000. You wouldn’t qualify for the additional residence allowance.

- Unmarried couples who own a home together. Your allowance is the same as a single person. You could qualify for the extra residence allowances but the criteria are complex. If you are leaving your partner the right to reside in the property, or if some of your share of the property goes to your partner’s children, then you no longer qualify for those allowances.

If you are married or in a civil partnership, there is less risk – because assets passed to your spouse on death are exempt from Inheritance Tax. There are also transferable allowances between couples too. This is where there is possibility of a combined allowance of £1m.

However, for larger estate – worth more than £2m – you start to lose allowances.

More and more clients are in the position where their estate may now qualify for Inheritance Tax. So what can you do about it?

Avoiding Inheritance Tax

There are a number of ways you can reduce the size of your taxable estate. We suggest you take good financial advice if your estate is likely to become subject to IHT, especially as 2023 Inheritance Tax allowances aren’t likely to change for a few years! Here are a few thoughts:

- Make a Will! Without one, your estate is distributed according to the rule of ”intestacy”, and that could mean paying inheritance tax that could have otherwise been avoided.

- Pensions aren’t subject to IHT. So boosting your pension if you can means less of your money is subject to IHT.

- Gifts – the £3000 a year rule. Lots of people quote “yes I can give away £3000 a year” to me, and that is true – you can give this away every year with no IHT consequences. But you can also give away more …

- Larger gifts. You can give away larger amounts – as much as you want really. But you need to survive 7 years before the amount is deducted from your estate for IHT purposes.

- Downsize your property and gift the surplus – but see above about “the seven-year rule”.

- Gifts from surplus income – you can give away money you don’t need. But you need to keep detailed records to provide that it didn’t affect your lifestyle.

- Invest in qualifying shares – businesses or alternative investments – but make sure you take proper financial advice for this!

- Place your life insurance in trust – this removes it from your estate for IHT purposes! And it pays out much quicker too as it does not have to wait for probate!

- Include a trust in your will for those you are leaving assets to. That can protect their own IHT position in the future.

- consider leaving money to charity – these gifts reduce the size of your taxable estate and mean that your IHT rate could be reduced to 36%

One thing NOT to do is gift your property to your children/grandchildren and then continue to live in it. This could be seen as a Gift with Reservation of Benefits (GROB) and may still count in your estate when you die!

Is Inheritance Tax going to be scrapped?

There is a lot of speculation at present around this. The Telegraph is running a campaign to get “unfair” IHT scrapped, and it has gained a lot of traction. There are also rumours that the current government is considering this instead of giving wider income tax cuts – it will cost them less.

But be careful what we wish for. If IHT is scrapped, then it is possible other taxes such as Capital Gains Tax on death could be introduced/increased. And socially it could have lots of consequences – increasing inequality and reducing social mobility. It could also widen the gap between the rich and poor if wealth can be handed down more easily. And have the potential to allow people to just sit back and rely on a future inheritance!

Whatever happens, something needs to change ….

Perhaps the best we can hope for is that the government increase IHT allowances and simplify the complex qualifying criteria. That way more of us get all the potential allowances and make the most of what we can pass on.

Even if changes are made, it’s unlikely that the 2023 inheritance Tax allowances will change immediately. So take actions now!

How can we help?

When we talk to you about your Will, we also go through your financial position too. That way we can advice you of your current allowances, and any actions you may wish to take. That could include placing life insurance into trust or updating your pension nomination forms.

If needed, we can put you in touch with one of our network of trusted financial advisors for help and assistance with investments or pensions.

We can also ensure your Will maximises the available allowances and rules. This could include making sure your property gift allows your estate to qualify for the residence allowance. Or including a trust to maximise IHT allowances for the people you are leaving assets to.

Whatever your situation, we want to make sure you know about, and understand, what IHT means for your own individual circumstances, and help you to act if it’s needed – now or in the future.

Contact us on 01524 5710232 to arrange an appointment, or a FREE 30-minute consultation. We are here to help!

If you’d like more details about 2023 Inheritance Tax allowances and rules, read our previous blog here or check out the government website here.