Enduring, Lasting, General. Ordinary – all these are different types of Powers of Attorney. But do you know the difference? And do you know which one is best for you and your family? Here is an overview of them, their uses, and (for some types) their limitations!

One of the older types of Powers of Attorney is an ENDURING POWER OF ATTORNEY (EPA)

These types of Powers of Attorney were issued until 2007 and were then replaced by Lasting Powers of Attorney (LPAs). EPAs are no longer issued, and their use is limited to financial affairs. You may wish to consider replacing them with LPAs for more security and for future proofing. You may also want to provide authority for those you trust to make decisions about your health and welfare. This is because:

- They only cover financial affairs.

- Creation of LPAS is more secure.

- LPAS allow you to appoint replacements.

- LPAs are more flexible.

- There is more supervision and safeguarding with LPAs.

This excellent blog by the Society of Will Writers explains all the above in a lot more detail. But so can we! Just give us a call for a free 30-minute consultation and we can chat about whether your circumstances mean you should think about replacing them.

The current types of Powers of Attorney are LASTING POWERS OF ATTORNEY (LPAS)

These are the current powers that are issued and registered by the Office of the Public Guardian who are responsible for administration and safeguarding.

There are two types:-

Health and Welfare

- The Health and Welfare LPA allows attorneys to make decisions on your behalf about personal welfare, care and treatment.

- This ranges from simple day to day care, decisions about care homes, and all the way up to consenting to, or refusing, life sustaining treatment ( if included in the LPA).

- Can only be used when donor has no capacity

Property and Finance

- The Property and Financial Affairs LPA allows attorneys to make decisions on your behalf about personal finances and property matters.

- This can include dealing with banks, filling in forms ( e.g. DWP), paying utility bills, organising insurance and even selling a property.

- Can be used as soon as registered

Both types of LPA need to be registered with the Office of the Public Guardian and require someone to act as “certificate provider”. That’s the person who confirms that you have the capacity to make, and fully understand, a Power of Attorney. We can act in that capacity for you.

Whilst most people think that any of the different types of Powers of Attorney are just for older people, we highly recommend LPAs for anyone over the age of 25. You never know what is round the corner. A serious accident could have devastating consequences in more ways than one if those you trust aren’t able to act for you, or make decisions for you. Arrange a free 30-minute consultation with us to get more information about how they work or why you need them! Or ask for one or more of our FREE guides here.

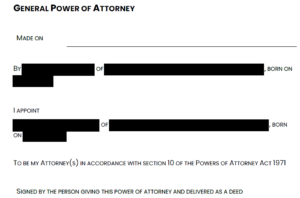

One of the simplest types of Powers of Attorney is a GENERAL POWER OF ATTORNEY (GPA)

This is sometimes referred to as an Ordinary Power of Attorney.

A bit like an Enduring Power of Attorney it can only be used for financial affairs. As it doesn’t need to be registered, it can be used as soon as it is signed and witnessed. However, it has a huge drawback – it is only valid while the donor has mental capacity. If you lose capacity, your GPA is no longer usable and your attorneys can’t make any more decisions for you.

A GPA is a useful interim document as it can be used while waiting for your LPAs to be registered. In some cases, we offer these free of charge to our clients as a temporary solution while we work on their LPAs being registered. But it cannot be relied on as a long-term solution – and remember – it doesn’t cover health decisions.

Whichever of the different types of Powers of Attorney you have, or need, we are here to guide you. We can help you understand what’s best in the long term to protect you, your family, and your business.

Making a Power of Attorney makes it so much easier for those you love. It really is one of the kindest things you can do! Start today by calling us on 01524 571032 to book in an initial discussion with us.